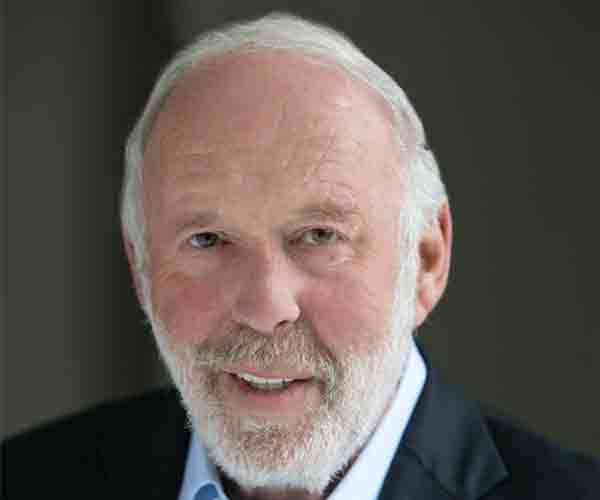

Boaz Weinstein

Boaz Weinstein (1973) grew up on Manhattan’s Upper West Side. He became a national chess master at age 16. After summer jobs at Goldman Sachs, and stints at Merrill Lynch and Donaldson, Lufkin & Jenrette, Weinstein became the youngest ever managing director at Deutsche Bank, at age 27. He was Co-Head of Global Credit Trading, overseeing a team of approximately 650 professionals. He rose to prominence in 2006 and 2007 when the Saba proprietary trading group cleared over $1.5 billion in profits. Weinstein graduated from Stuyvesant High School in New York City and from the University of Michigan in 1995 with a degree in Philosophy.

Saba Capital Management

Saba Capital Master Fund

Start date

Apr 2009

Apr 2009

Annual return

8.32%

8.32%

Annual volatility

15.2%

15.2%

AuM

$ 2.7bln.

$ 2.7bln.

Weinstein founded Saba (“grandfather” in Hebrew) in 2009, lifting 15 members out of his Deutsche Bank team to start his own credit-focused hedge fund. Saba launched its flagship fund in August 2009 with $140 million.

Saba employs a relative value strategy in credit markets, putting on asymmetric risk-reward trades, typically involving credit derivatives such as credit default swaps (‘CDS’). The long volatility nature of the strategy makes it a reliable diversifier in terms of market havoc. And in periods of declining volatility, of which we have seen many over the past 10 years, Saba has proven to be nimble and to find strategies that can be exploited in any volatility regime, such as Closed End Fund arbitrage, buying fixed income ETF trading at large discounts to NAV and actively pursuing the closing of the discounts.

Saba is a boutique, with 30 professionals. Assets, mid 2020, were at $ 2.6bln. The firm has much less competition these days as most competitor relative value funds have closed shop after many years of disappointing returns. Also, due to regulations, the proprietary desks, of which Weinstein once ran one, are hardly taking any risk on anymore.

The Saba Capital Master Fund runs a credit long/short strategy, a carry neutral tail risk strategy, a closed end fund strategy and an capital structure arbitrage strategy. Following the COVID-19 pandemic and subsequent record rally in the US High Yield Indices, Weinstein saw more mispricings then ever before in his career. This is when we entered the strategy for Legends Fund.

Saba employs a relative value strategy in credit markets, putting on asymmetric risk-reward trades, typically involving credit derivatives such as credit default swaps (‘CDS’). The long volatility nature of the strategy makes it a reliable diversifier in terms of market havoc. And in periods of declining volatility, of which we have seen many over the past 10 years, Saba has proven to be nimble and to find strategies that can be exploited in any volatility regime, such as Closed End Fund arbitrage, buying fixed income ETF trading at large discounts to NAV and actively pursuing the closing of the discounts.

Saba is a boutique, with 30 professionals. Assets, mid 2020, were at $ 2.6bln. The firm has much less competition these days as most competitor relative value funds have closed shop after many years of disappointing returns. Also, due to regulations, the proprietary desks, of which Weinstein once ran one, are hardly taking any risk on anymore.

The Saba Capital Master Fund runs a credit long/short strategy, a carry neutral tail risk strategy, a closed end fund strategy and an capital structure arbitrage strategy. Following the COVID-19 pandemic and subsequent record rally in the US High Yield Indices, Weinstein saw more mispricings then ever before in his career. This is when we entered the strategy for Legends Fund.