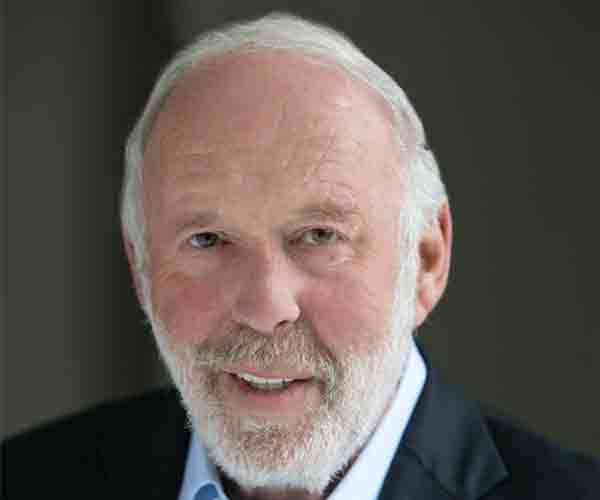

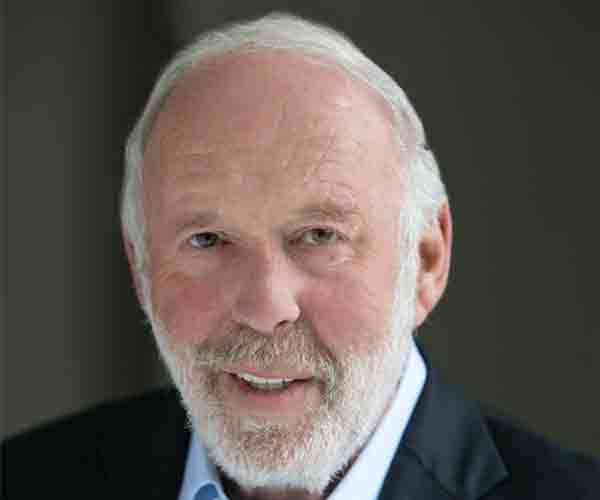

Jim Simons

James Harris "Jim" Simons (1938) received a Ph.D in mathematics from the University of California, Berkely at the age of 23. Next to founding Renaissance Technologies, Simons is also known for his studies on pattern recognition for which he developed (with Shiing-Shen Chern) the Chern–Simons form, and contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory. From 1968 to 1978, Simons was a mathematics professor and subsequent chair of the mathematics department at Stony Brook University. In 2016, asteroid 6618, discovered by Clyde Tombaugh in 1936, was named after Simons by the International Astronomical Union in honor of his numerous contributions to mathematics and philanthropy.In 2011, Simons was included in the 50 Most Influential ranking of Bloomberg Markets Magazine. Simons owns a motor yacht, named Archimedes. It was built at the Dutch yacht builder Royal Van Lent and delivered to Simons in 2008. On October 10, 2009, Simons announced he would retire on January 1, 2010 but remains at Renaissance as non-executive chairman. His personal money remains invested in the various Renaissance Funds.

“The advantage scientists bring…is less their mathematical or computational skills than their ability to think scientifically. They are less likely to accept an apparent winning strategy that might be a mere statistical fluke.”

- Jim Simons

Renaissance Technologies

Renaissance Institutional Equities Fund

Start date

Aug 2005

Aug 2005

Annual return

13.0%

13.0%

Annual volatility

11.0%

11.0%

AuM

>15bn

>15bn

Renaissance Technologies was founded by Jim Simons in 1982. The firm specializes in systematic trading using only quantitative models derived from mathematical and statistical analysis. Renaissance is considered the pinnacle of quant investing and is unique, even among hedge funds, for the genius – and eccentricity – of its people. Since Simon’s retirement in 2010, the firm is co-headed by Peter Brown and Robert Mercer, both Ph.Ds. Firmwide, assets under management are over $40bln. Of its 300 employees a third are Ph.Ds. Each day, Renaissance collects more than ten terabyte of data.

In 1988, Simons and algebraist James Ax established Renaissance’s most profitable portfolio, the Medallion Fund, which used advanced mathematical models to explore correlations from which they could profit. The fund was named after the math award Simons and Ax had won. Medallion Fund is widely considered the world best performing hedge fund of all time, annualizing over 35% percent even after fees as high as 5% management fee and 44% performance fees. In 1993, Renaissance stopped accepting new money from outsiders and any outside investors left were redeemed out of Medallion in 2005. Since then the fund has been run with just internal capital and any gains above its target size of USD 10 billion is distributed to those insiders. It was then that Renaissance launched the Renaissance Institutional Equities Fund (RIEF) which is the fund that Legends Fund participates in.

RIEF trades equities on U.S. exchanges to capitalize on medium- to long-term market inefficiencies that they believe will produce alpha over the long term. The fund mainly differs from Medallion in that it trades on longer time horizons where markets offer more capacity for their strategies. While Medallion Fund clearly is a class by itself, RIEF produces highly attractive returns with limited correlation to overall markets. The fund charges relatively low fees with 0.35% management fee and 10% performance fee and most of its 15bln in assets is internal capital, a fairly unique feature at a quantitative hedge fund.

In 1988, Simons and algebraist James Ax established Renaissance’s most profitable portfolio, the Medallion Fund, which used advanced mathematical models to explore correlations from which they could profit. The fund was named after the math award Simons and Ax had won. Medallion Fund is widely considered the world best performing hedge fund of all time, annualizing over 35% percent even after fees as high as 5% management fee and 44% performance fees. In 1993, Renaissance stopped accepting new money from outsiders and any outside investors left were redeemed out of Medallion in 2005. Since then the fund has been run with just internal capital and any gains above its target size of USD 10 billion is distributed to those insiders. It was then that Renaissance launched the Renaissance Institutional Equities Fund (RIEF) which is the fund that Legends Fund participates in.

RIEF trades equities on U.S. exchanges to capitalize on medium- to long-term market inefficiencies that they believe will produce alpha over the long term. The fund mainly differs from Medallion in that it trades on longer time horizons where markets offer more capacity for their strategies. While Medallion Fund clearly is a class by itself, RIEF produces highly attractive returns with limited correlation to overall markets. The fund charges relatively low fees with 0.35% management fee and 10% performance fee and most of its 15bln in assets is internal capital, a fairly unique feature at a quantitative hedge fund.