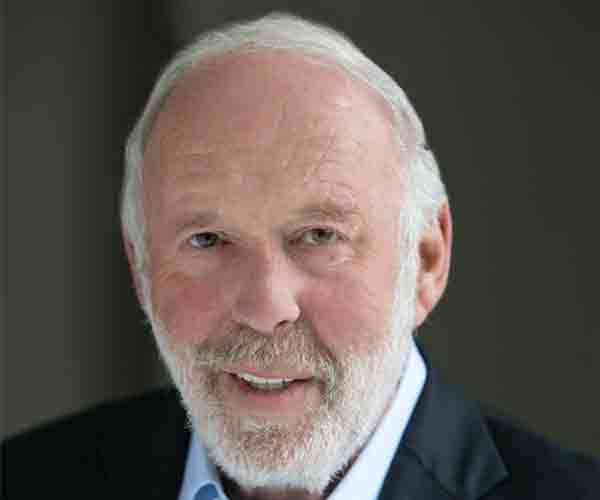

Robert Gibbins

Robert Gibbins (1970) received a BS degree in Economics (cum laude) from the Wharton School at the University of Pennsylvania. Prior to founding Autonomy Capital in 2003, he was the head of Emerging Markets and Global Macro Proprietary Trading at Lehman Brothers during its heydays of 1996-2003. Before that he was responsible for Lehman’s FX and Interest rate trading within Northern Europe. He began his career at JP Morgan in 1992.Mr. Gibbins works from Autonomy’s office in Nyon, Switzerland, but travels extensively to do on-the-ground research across both developed and emerging markets. This local, in-country research is one of the key characteristics of this manager’s strategy and it sets him apart from most of his peers.

We have been invested with Mr. Gibbins for well over 10 years and have experienced first-hand his ability to spot important structural developments early on and to successfully position his fund to capitalize on them. He holds a low profile and rarely makes public appearances.

Autonomy Capital

Autonomy Global Macro Fund

Start date

Nov 2003

Nov 2003

Annual return

14.1%

14.1%

Annual volatility

14.1%

14.1%

AuM

>3 bn

>3 bn

Autonomy Capital was founded in 2003 by Robert Gibbins who remains responsible for all of Autonomy’s investment activities today. The firm specializes in thematic, multi-asset class investing with a bias towards emerging markets. Autonomy employs a combination of top-down global macroeconomic analysis with fundamental bottom-up security selection. The cornerstone of Autonomy’s investment process involves local, in-country research and due diligence yielding relationships that fortify the firm’s invaluable global intelligence network.

Autonomy’s team stands out in analyzing and deciphering political and cultural macroeconomics. The investment professionals have extensive experience conducting research, investing, and advising governments on economic policy.

The Autonomy Global Macro Fund has a flexible approach and implements investment ideas through sophisticated trade expression in all asset classes with a focus on rates, foreign exchange, credit and equity instruments. The team exists of 114 people across 7 offices. 26 of these are investment professionals for the Macro Fund. The firm’s investment team ranks among the best in the world in the area of emerging markets and has seen little turnover over the years.

Occasionally, Autonomy will launch specialized vehicles to allow investors to get dedicated exposure to high conviction ideas. Examples include the launch of an Iceland Fund in the midst of the European debt crisis and a Spanish Real Estate Fund after local real estate prices had plummeted. The firm’s track record in this area is second to none.

The Autonomy Global Macro Fund is closed for new capital as the manager wants to avoid diluting its return prospects. Robbert Gibbins has the vast majority of his own money invested in the fund and represents the fund’s single largest investor by a significant margin.

Autonomy’s team stands out in analyzing and deciphering political and cultural macroeconomics. The investment professionals have extensive experience conducting research, investing, and advising governments on economic policy.

The Autonomy Global Macro Fund has a flexible approach and implements investment ideas through sophisticated trade expression in all asset classes with a focus on rates, foreign exchange, credit and equity instruments. The team exists of 114 people across 7 offices. 26 of these are investment professionals for the Macro Fund. The firm’s investment team ranks among the best in the world in the area of emerging markets and has seen little turnover over the years.

Occasionally, Autonomy will launch specialized vehicles to allow investors to get dedicated exposure to high conviction ideas. Examples include the launch of an Iceland Fund in the midst of the European debt crisis and a Spanish Real Estate Fund after local real estate prices had plummeted. The firm’s track record in this area is second to none.

The Autonomy Global Macro Fund is closed for new capital as the manager wants to avoid diluting its return prospects. Robbert Gibbins has the vast majority of his own money invested in the fund and represents the fund’s single largest investor by a significant margin.